when are property taxes due in madison county illinois

Statement of Economic Interest. CHRIS SLUSSER Madison County Treasurer IL 157 North Main Street Ste.

Madison County Hears Debate Over Referendums Chairman S Powers

In most counties property taxes are paid in two installments usually June 1 and September 1.

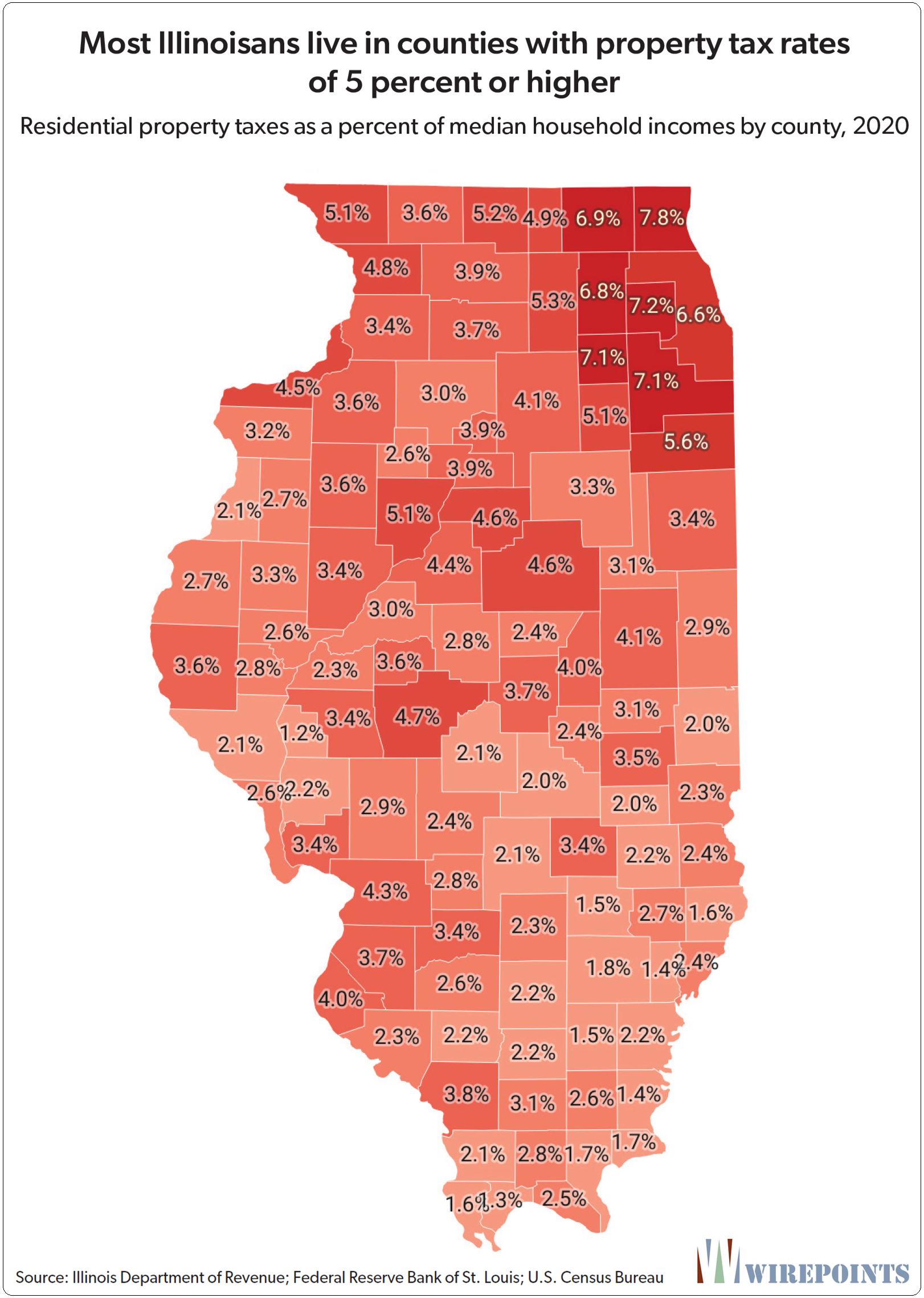

. Illinois Property Taxes Go To Different State 350700 Avg. 173 of home value Tax amount varies by county The median property tax in Illinois is 350700 per year for a home worth the. Normally every three years at a minimum a county assessor re-examines and decides whether to revise propertys estimated worth.

The Treasurers Office reminds if you. Click here Pay your Madison County property. Madison County Clerk PO.

LAST DAY TO PAY PROPERTY TAXES FOR TY 2020 ON OUR WEBSITE WILL BE FEBRUARY 18 2022 at 430 pm. Box 218 Edwardsville IL 62025. 175 of home value Yearly median tax in Madison County The median property tax in Madison County Illinois.

Property tax bills should land in mailboxes across Cook County around the same time as holiday cards with second installment payments expected to come due before the end. Current Tax Year-Taxing District Levy. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Madison County Property taxes are paid in four installments. Monday - Friday E-mail. You are about to pay your Madison County Property Taxes.

Payment of the installment due on June 1 2022 with interest beginning on June 2 2022 at 55 per month post-mark accepted. When are taxes due in Madison County. Its September 7 and that means if you live in Madison County the second installment for paying your property tax bill is due today.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. For comparison the median home value in Madison County is. 2019 payable 2020 tax bills are being mailed May 1.

125 Edwardsville IL 62025 618-692-6260. Madison County Illinois Property Tax Go To Different County 214400 Avg. Will County Il Property Tax Due Dates 2022.

Madison County Auditor Financial Reports. Pay your Madison County Illinois property tax bills online using this service. A reassessed value is then multiplied times a composite.

Madison County Auditor Check Register. If you are making payments after January 3rd due to interest and late fees please call our office at 256 532-3370 for an exact tax amount due. For now the September 1 deadline for the second installment of property taxes will remain unchanged.

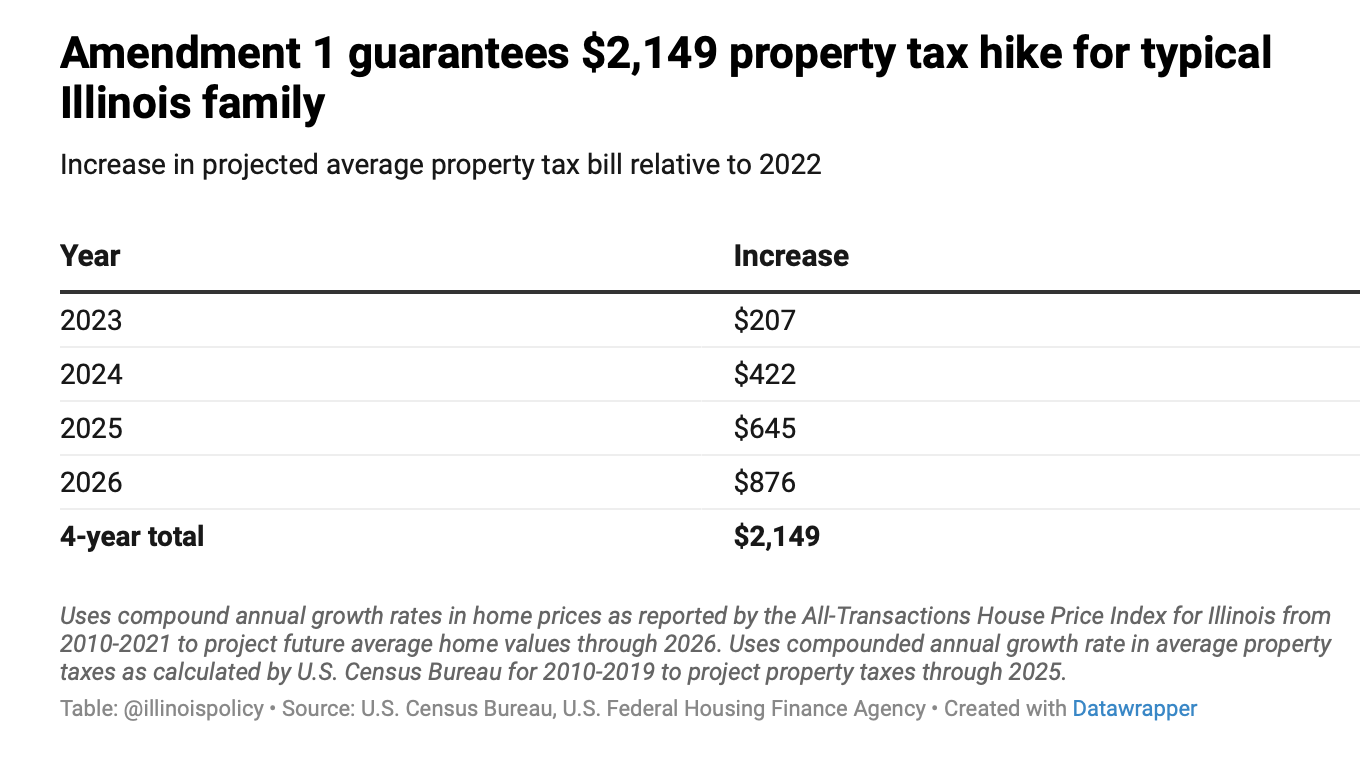

Amendment 1 Will Raise Your Property Taxes Here S How Cook County Record

Recently Sold Homes In Madison County Il 16 839 Transactions Zillow

Madison County 1812 2012 Reflecting Illinois And National History Madison Historical

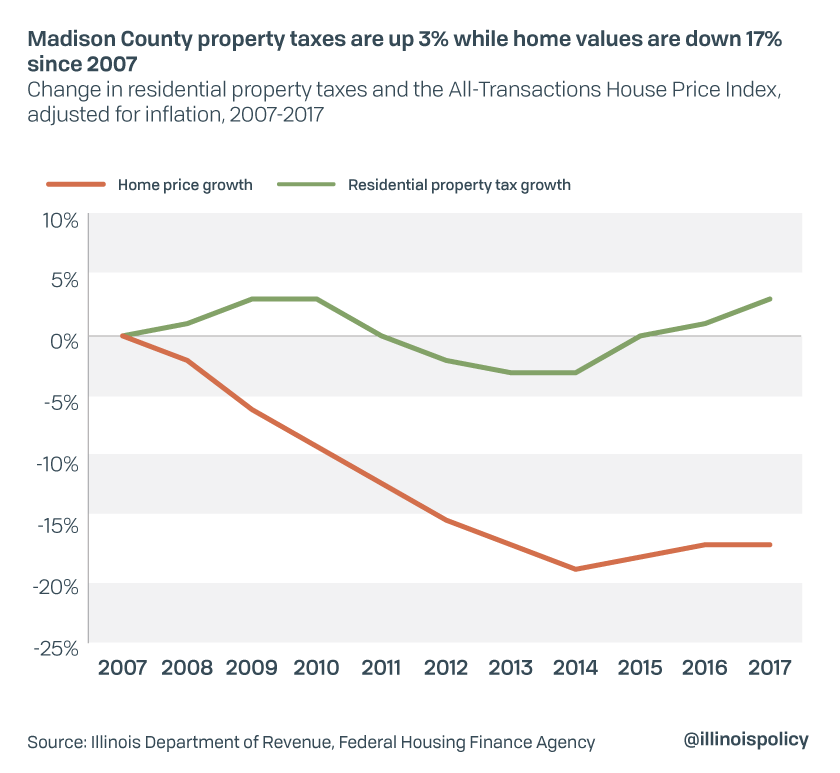

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record

Madison County Treasurer Facebook

Madison County Home Values Down 17 Property Taxes Up 3 Since Recession

Illinois Sales Tax Rate Rates Calculator Avalara

Sales Taxes In The United States Wikipedia

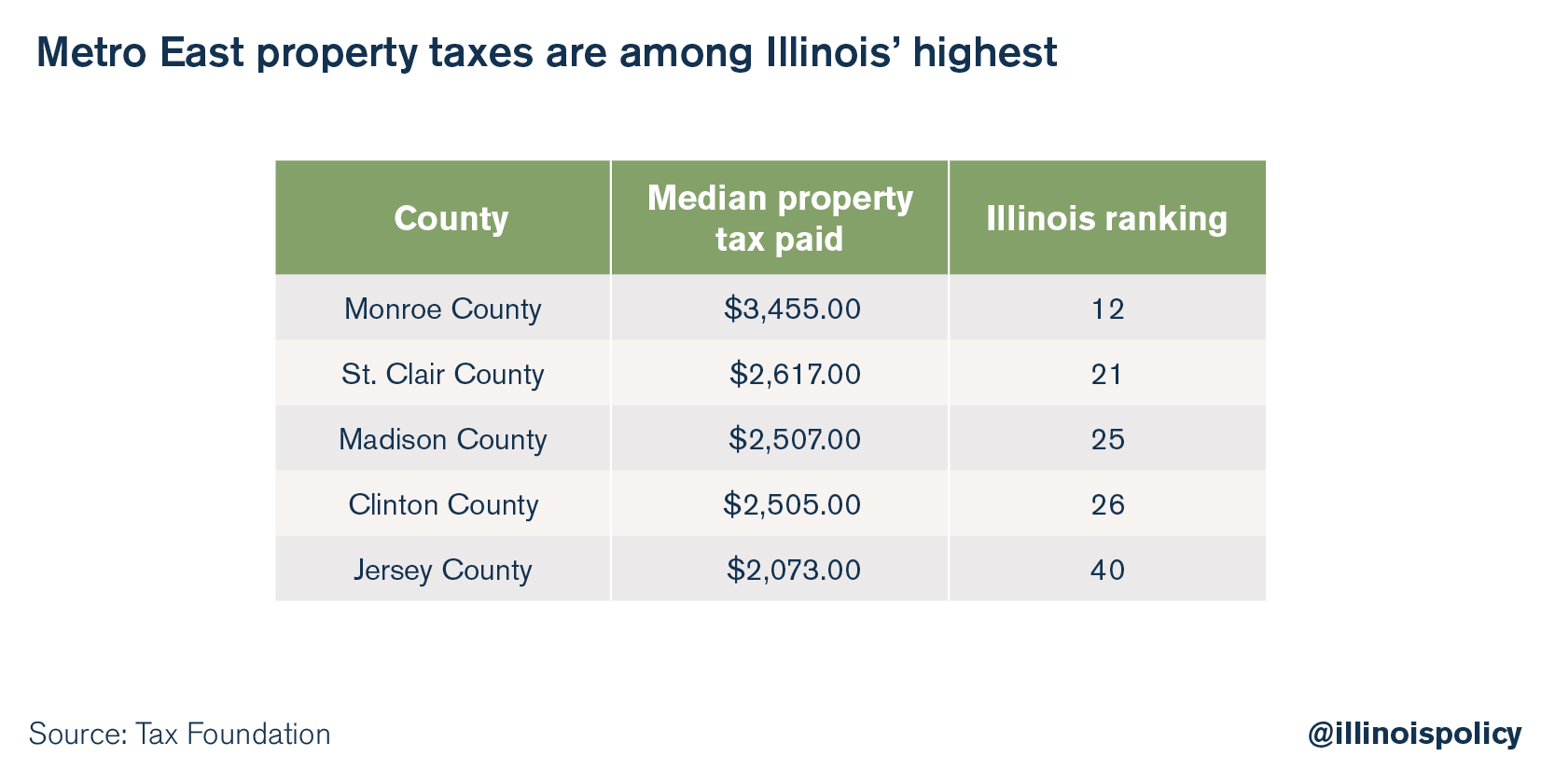

Metro East Median Property Taxes Rank In The Top 50 Highest In Illinois

Madison County Looks To Lower Maximum Property Taxes Illinois Stltoday Com

Madison County Treasurer Facebook

Madison County Sales Tax Department Madison County Al